About Us

RB Patel Group Limited (RBG) is a publicly listed company that has a diversified business portfolio and is involved in operating supermarkets which include department stores, distributing, importing, exporting, wholesaling and property development and management.

RBG is the only supermarket chain that is publicly listed on the South Pacific Stock Exchange (SPX) having listed on the 17th of July 2001. It is the only publicly listed supermarket chain in Fiji.

RBG operates twelve supermarkets on the two major islands of Fiji, and have the largest range of online shopping and are known for their great customer service, great pricing, great range that makes it easier for customers as well as saving them time with all they want being available in one shop..

In addition to groceries RBG also carries a wide range of kitchenware, porcelainware, plasticware, drapery items and electrical appliances. It’s a complete departmental store – A One Stop Shop for our customers!

Financial Performance

Despite growing competition in a low margin industry, RBG has continued with its impressive performance for several years in a row. In the financial year ended 30 June 2023 the total revenue was $170 million with a profit before tax of $15.7million.

RBG’s growing and well managed commercial property portfolio provides considerably strength to its balance sheet. Rental revenue in the 2023 year was $4.5 million. The total investment portfolio is now valued at $59 million.

While such capital growth has continued to support and strengthen the balance sheet, it has also set up a platform for the company against which to grow future earning using financial leverage. To date the company has used its balance sheet very efficiently to generate revenue. This coupled with healthy profit margins and a low debt to equity ratio (Gearing) the company has generated an excellent return on equity (ROE) for its shareholders. RBG has proved itself to be a steady growth company delivering improved results each year.

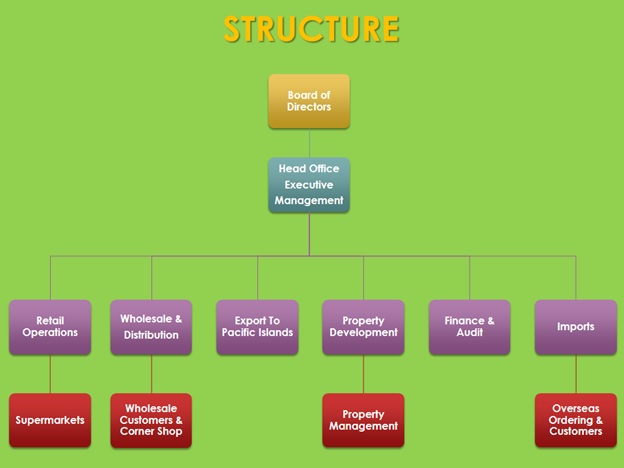

Structure